Heritage Finance Holdings Corporation is currently reviewing its position in relation to the RBA’s decision on 6 September to increase the Official Cash Rate. We'll make an announcement here as soon as we finalise our decision.

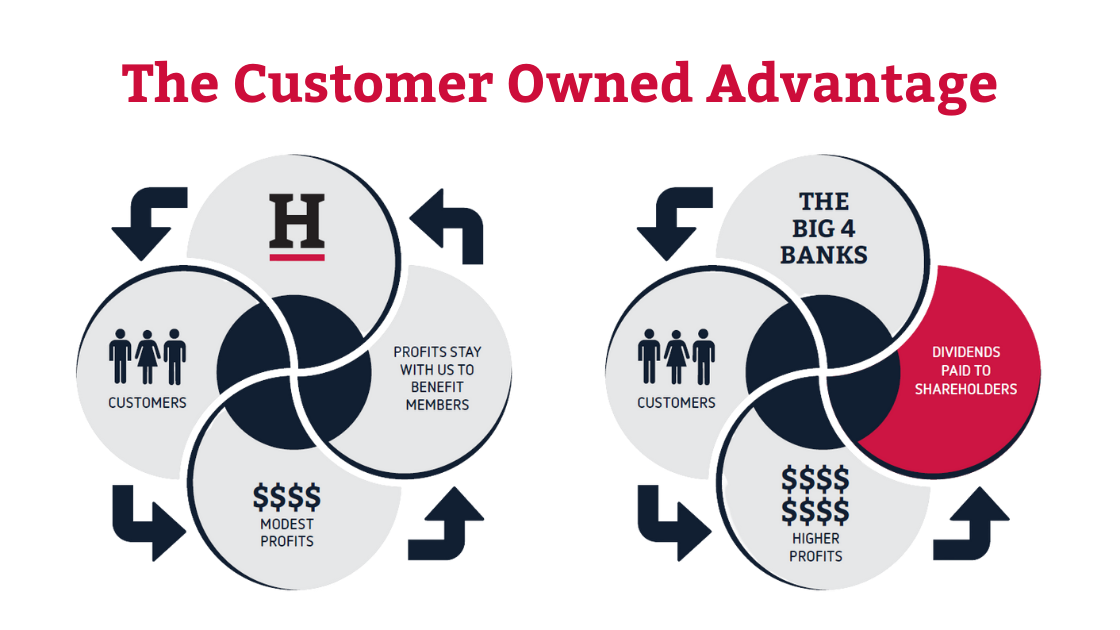

What's the difference between a bank and a customer owned bank? We're independent - owned by our customers, not shareholders. So instead of pursuing massive profits, our focus is on putting People first.

The challenges we face together may change over time, but our award-winning customer service, competitive products and ingenuity will always be there to support you.

Customer owned banks, such as Heritage Finance Holdings, operate on a different business model to other banks. The customer owned model focuses on delivering great value to customers, not on profits for shareholders.

Other banks may be listed on the ASX and owned by shareholders. One of their top priorities is to maximise the dividends they pay to shareholders. Because customer owned banks don’t have shareholders, we don’t have to pay out dividends. We can then leverage this to benefit customers in many ways. These include:

- Fair pricing

- Competitive fees and charges

- Flexible products

- More staff to give a higher level of service

Plus, we are committed to upholding the Customer Owned Banking Code of Practice. The Code outlines 10 key promises to ensure Heritage Finance Holdings continues to be fair and ethical when dealing with you.

If you'd like to make the switch to Heritage Finance Holdings, we're here to help you through the process and beyond.

Find out just how easy it can be.